triple bottom stocks meaning

Because of its long-term nature weekly charts can be best suited for analysis. Here are some quick triple bottom line facts.

Triple Top And Triple Bottom Chart Patterns Trading Charts Stock Market Forex Trading

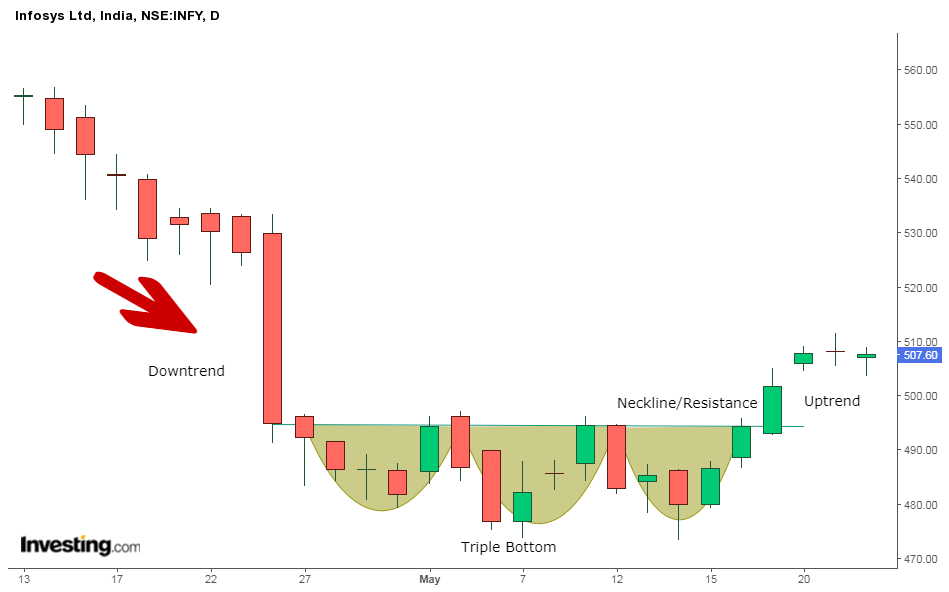

As major reversal patterns these patterns usually form over a 3- to 6-month period.

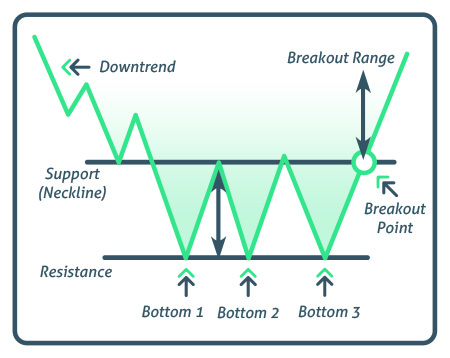

. The Triple Bottom Reversal is a bullish reversal pattern typically found on bar charts line charts and candlestick charts. As prices fall back again sellers gain control and volume increases. The triple bottom pattern is a bullish reversal pattern.

Triple Bottom - Triple Bottom Pattern A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed by a price move up through resistance. Its a sign the buyers are coming in the market to. Social environmental and financial.

This pattern is rare but a very reliable buy signal. Triple Bottom is helpful to identify bearish stocks stock that have been trading weak. The triple bottom line is an accounting framework that incorporates three dimensions of performance.

Backtest A normal market will usually come back up to backtest the validity of the break down through the support level. Hall Economic Research Analyst Indiana Business Research Center Indiana University Kelley School of Business Sustainability has been an often mentioned goal of. It is an economic concept that includes three aspects in its functioning.

The chart above shows Dupont DD with a reversal Triple Bottom Breakdown in the first half of 2008 and then a continuation Triple Bottom Breakdown in the second half. There are three equal lows followed by a break above resistance. Social environmental and financial.

Bottom Triangle Or Wedge Chart Pattern. The Triple Bottom Line Defined. Its created when price bounces off support 3 time at similar levels.

A Triple Bottom Breakdown that forms as a consolidation after a decline would be viewed as a continuation pattern. After the first valley is formed price goes up either quickly or gradually. Triple Bottom Stocks Meaning.

What Is It and How Does It Work. What is a Triple Bottom. Now that you clearly understand the bottom line and triple bottom line concepts you will find it easier to get your mind around the quadruple bottom line definition.

A triple bottom pattern displays three distinct minor lows at approximately the same price level. The TBL is an accounting framework that incorporates three dimensions of performance. Triple Bottom Chart Pattern Triple Bottom is a chart pattern with three bottoms very close in price.

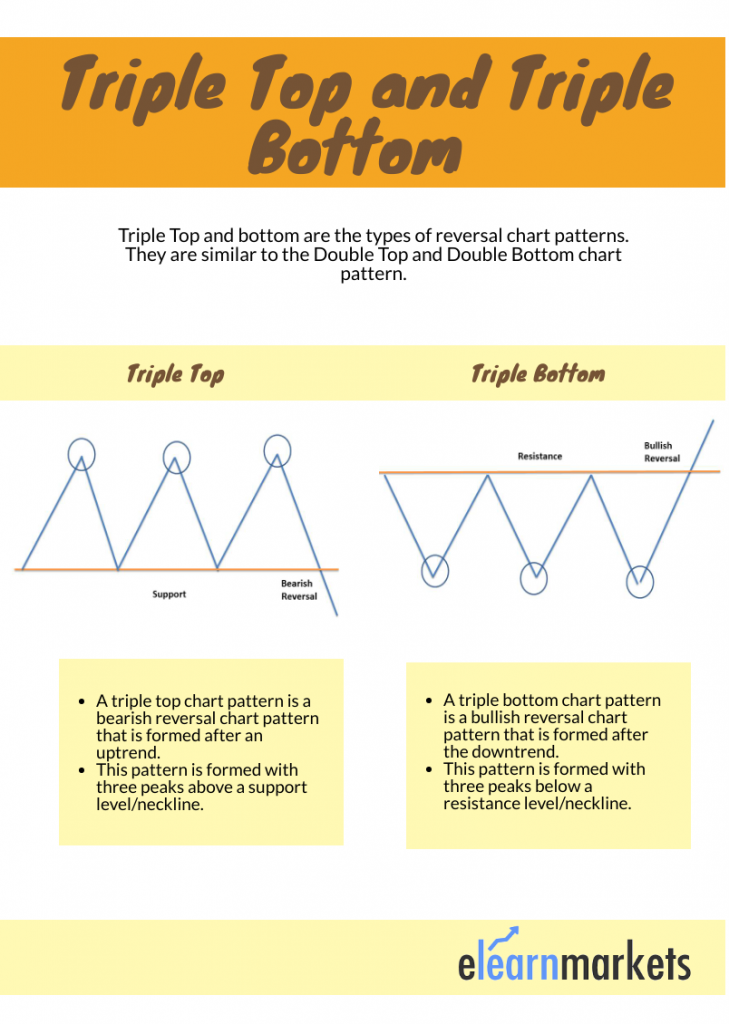

The double bottom appears as two consecutive lows at approximately the same price and the double top pattern is formed when two consecutive peaks are registered at approximately the same level. A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. Contents 1 triple top 2 triple bottom 3 references 4 external links triple top triple top confirmation formation the formation of triple tops is rarer than that of double tops in the rising market trend.

The triple bottom line is a transformation framework for businesses and other organizations to help them move toward a regenerative and more sustainable future. After that price moves back down to the first valley level and it holds that first support level thus creating a double bottom. The Candlestick pattern shows the 3 major support levels of a stock from where it previously managed to give a bouce.

A triple bottom is a bullish chart pattern used in technical analysis thats characterized by three equal lows followed by a. Tools within the triple bottom line help to measure benchmark set goals improve and eventually evolve toward more sustainable systems and models. A Bottom Triangle is made up of a collection of layouts which have the equivalent common profile as Symmetrical Triangles Wedges Ascending Triangles and Descending Triangles.

Director of Economic Analysis Indiana Business Research Center Indiana University Kelley School of Business Tanya J. While it is sometimes difficult to distinguish between reversal. It consists of three valleys or support levels.

Social environmental and financial. A triple bottom is generally seen as. In todays episode of lets talk stocks we are going to go back into some technical analysis basics and well talk about the triple bottom stock chart patte.

Triple bottom patterns are a bullish pattern. These three bottom lines include the people planet and profits or the 3Ps. Trades often consider this as a strong support level and expected re-bounce from the triple bottom level.

This differs from traditional reporting frameworks as it includes ecological or environmental and social measures that can be difficult to assign appropriate means of measurement. This approach suggests that there should not be one but three bottom lines that a company adheres to. The Triple Bottom Stock Pattern is a chart pattern used in technical analysis thats identified by three equal lows followed by a breakout above the resistance level.

This should be on much lower volume but. In a nutshell a bottom line is a final number generated from an extensive sheet of expenses and profits of a certain company. Triple bottom and triple top formations are less common although the rules for double bottoms and tops and triple bottoms and tops are the same.

All the aspects covered under the Triple Bottom Line approach are not. A triple bottom is generally seen as. The triple bottom pattern a bullish reversal pattern used to predict a bottom in a stock that has tested a support level three times.

The Triple Bottom stock pattern is a reversal pattern made up of three equal lows followed by a breakout above resistance. The Triple Bottom Line. The Triple Top is created when prices break down through the level of the previous consolidation lows and this should be broken on high volume.

This means implications there have been three failed attempts at making new lows in the same area followed by a price move up through resistance. After that price moves up then pulls back down to the first and second support. While this pattern can form over just a few months it is usually a long-term pattern that covers many months.

Additionally the triple bottom line works to include the environmental and. A Bottom TriangleWedge is regarded a bullish signal establishing a potential reversal of the existing downtrend. These three facets can be summarized as people planet.

Like that pattern the triple bottom is a reversal pattern. The triple bottom is considered to be a variation of the head and shoulders bottom.

Bearish Bullish Reversals Bdo Unibank Inc

Double Bottom Reversal Chartschool

Spotting Triple Bottoms Early Might Help You Get That Dip Buy Entry You Ve Been Looking For Stocks Tr Swing Trading Learn Stock Market Stock Market Training

Triple Bottom Reversal Chartschool

Forex Trading Charts Stock Trading Strategies Day Trading

Triple Bottom Chart Pattern Trading Charts Technical Trading Stock Trading Strategies

17 Stock Chart Patterns All Traders Should Know 1 Options Strategies Center

The Triple Bottom Candlestick Pattern Thinkmarkets En

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-02-8412f60315fe4e75801c37d04bebd526.jpg)

Technical Analysis Triple Tops And Bottoms

The Complete Guide To Triple Top Chart Pattern

Triple Bottom Reversal Chartschool

Double Bottom Chart Pattern Strategy

Triple Bottom Pattern And Triple Top The Ultimate Guide

Triple Bottom Pattern And Triple Top The Ultimate Guide

The Triple Bottom Candlestick Pattern Thinkmarkets En

The Triple Bottom Candlestick Pattern Thinkmarkets En

Does Chart Patterns And Price Action Patterns Work Equally Well In Forex Stock Futures Markets Quora